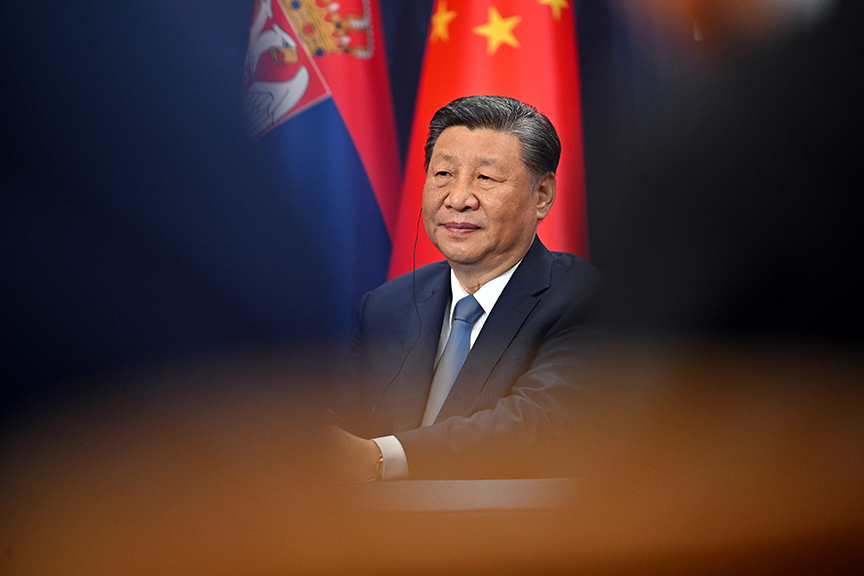

President Donald J. Trump has stated that China is buying up our country. The President’s stance on China and intrusive actions geared toward owning America’s infrastructure emphasizes restricting Chinese ownership in critical American industries, aiming to prioritize national security and economic sovereignty. Here are considerations on how this policy could positively impact independent U.S. manufacturers:

Reduced Competition from Foreign-Owned U.S. Assets

- Impact: With fewer Chinese acquisitions in the U.S., domestic manufacturers may face less competition from foreign-owned companies in certain industries. This could allow for more opportunities in sectors like technology, agriculture, and energy, where Chinese investments currently hold a strong presence. Independent manufacturers may find it easier to compete for resources, clients, and market share without the influence of foreign-owned corporations.

2. Increased Support for Domestic Supply Chains

- Impact: President Trump‘s policy proposal includes measures to secure American-made products, which could result in a positive national shift toward US product sourcing. For independent manufacturers, this can provide a greater demand for locally produced components and materials. Manufacturers relying on U.S.-based supply chains could benefit from government incentives or subsidies that encourage “Made in America” production, bolstering their place in the market and supporting the growth of jobs in the United States.

3. Expansion of ‘American First’ Contracts and Bidding Opportunities

- Impact: If the President’s administration restricts foreign ownership, government contracts for infrastructure and technology projects may prioritize U.S. manufacturers. Independent manufacturers would theoretically gain expanded access to public sector contracts that were previously open to foreign competition, creating a pathway for smaller businesses to compete for national contracts, particularly in strategic industries like energy, telecom, and defense.

4. Increased Innovation Funding and Reduced Foreign Dependence

- Impact: Trump’s stance on reducing foreign (especially China) ownership in sectors like technology and medical supplies could lead to increased funding for US innovation. Independent manufacturers could benefit from increased grants, research funding, and tax incentives aimed at strengthening American technological and industrial capabilities. This shift would allow investing in more advanced manufacturing techniques, infrastructure, and equipment.

5. Protection of Intellectual Property (IP) and Trade Secrets

- Impact: President Trump‘s policy will likely involve strict controls on IP ownership and transfer, particularly in technology and advanced manufacturing sectors. This could protect U.S. manufacturers from IP theft and trade secret exposure associated with foreign ownership, especially for those developing proprietary technologies. For smaller manufacturers, having a strong safeguard against IP infringement could encourage innovation without the fear of replication or unfair competition. (In a separate article, this could also help independent product manufacturers from the thievery rampant both by and on the Amazon platform.)

President Donald J. Trump’s policy direction stands to highly benefit independent U.S. manufacturers by creating a more supportive, competition-reduced environment with greater access to resources and protections against foreign influence while ensuring stability for U.S. industries dependent on global trade.