As Shein, the fast-fashion giant with a reported valuation of $66 billion, eyes a potential public offering, it finds itself at a crossroads marred by allegations of forced labor in its supply chain and a complicated geopolitical landscape. The company, known for its fashion-forward designs and affordable prices, surged to prominence during the COVID-19 pandemic, drawing global attention. However, it faces a series of hurdles that must be addressed before it can win over Wall Street.

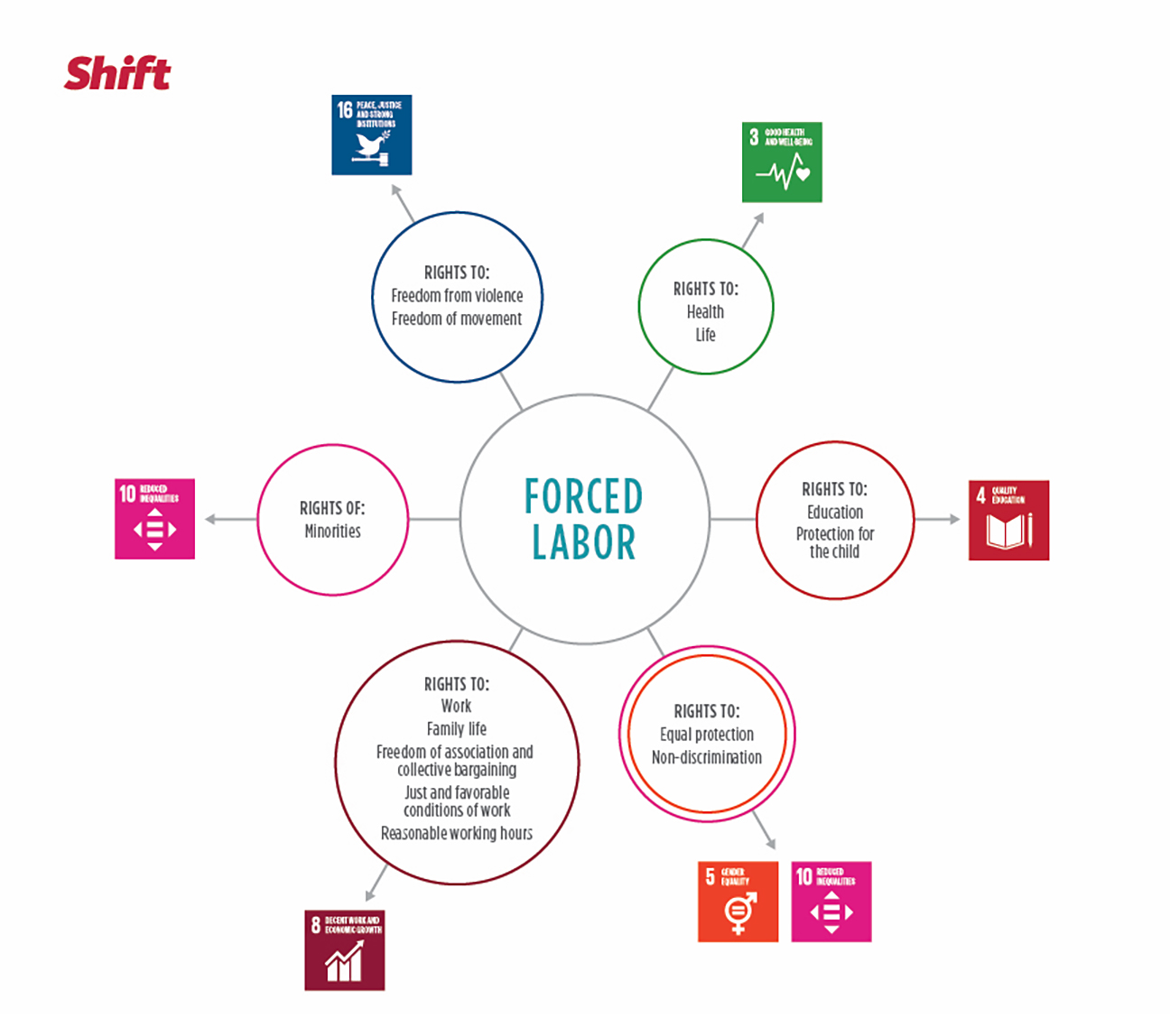

One significant challenge that Shein confronts is the ongoing investigation by the House Select Committee on the Chinese Communist Party. This investigation, initiated in May, revolves around allegations that Shein sources cotton and other materials from China’s Xinjiang region, an area marred by allegations of genocide, torture, and forced labor against the Uyghur ethnic group. Lawmakers responded by banning the import of products made in Xinjiang in 2021.

The investigation raises concerns about whether Shein’s supply chain may inadvertently involve forced labor due to a tariff law loophole called “de minimis,” which allows packages valued under $800 to enter the U.S. without import duties or rigorous customs oversight. Unlike traditional retailers that import and warehouse merchandise, Shein often ships products directly from Chinese suppliers to American consumers, potentially avoiding the same level of customs scrutiny.

While Shein maintains that it abides by all local laws and cooperates with investigations, the allegations remain a significant hurdle for its public offering ambitions. The investigation has also prompted Shein to engage with lawmakers and attempt to address their concerns.

Another challenge lies in Shein’s corporate identity and ties to China. While the company officially moved its headquarters to Singapore, emphasizing that it’s a Singapore-based company, the bulk of its extensive supply chain still remains in China. This move to Singapore was seen as an attempt to sanitize its image amid rising tensions between the U.S. and China. Still, critics argue that the Chinese government may still have influence over the company.

The debate over Shein’s status as a Chinese company or otherwise is further complicated by its extensive network of contracted manufacturers in China. While the company conducts audits to prevent labor violations, these audits only cover a fraction of its suppliers, leaving room for concern about labor practices in the broader supply chain.

In response, Shein has been working on localizing its supply chain, seeking to reduce its reliance on Chinese suppliers by establishing manufacturing hubs in other countries, such as Brazil and Turkey. While Shein is making efforts to address these challenges, the question of whether it is sufficiently detached from the Chinese government remains a point of contention.

Shein also faces copyright infringement claims, with designers accusing the company of stealing designs for its products. While Shein maintains a “zero tolerance policy” for copyright infringement, allegations persist.

The company’s fast-fashion strategy also raises sustainability concerns, as critics argue that its products may contribute to environmental issues, with many items ending up in landfills after only a few uses. This presents a challenge as younger generations are increasingly concerned about the environment and sustainability.

Under looming SEC rule changes, Shein would be required to disclose its greenhouse gas emissions if it were to go public. The company has already released this information in its 2022 ESG report, though it remains to be seen whether concerns about its environmental record will impact its sales.

While Shein faces a series of hurdles, the company’s innovation and business strategy have fueled its success. If it can address the forced labor allegations, navigate its shifting identity and ties to China, manage copyright infringement claims, and address sustainability concerns, it may find success on Wall Street. However, these challenges are significant, and the company must deploy its innovation effectively to overcome them.

Despite these challenges, Shein has not yet filed for an initial public offering, though reports suggest it could come as soon as 2024. The company remains ambitious, but it must prove to investors that it can address these concerns and present a straightforward story to win trust and support for its potential public offering in the United States.