In a groundbreaking move set to reshape the landscape of corporate accountability, California has ushered in new climate disclosure laws that promise to illuminate the often overlooked realm of corporate governance within the ESG (Environmental, Social, and Governance) triumvirate. Effective from 2026, large companies operating in the state will be compelled to divulge both direct and indirect greenhouse gas emissions, climate-related financial risks, and their strategies for mitigating these risks.

The forthcoming disclosures and the preparatory work leading up to them are poised to cast a spotlight on the nexus between corporate governance practices and social and environmental performance. These revelations are expected to underscore the power of governance as a driving force behind tangible progress in climate action and social justice, signaling a pivotal moment for a reevaluation of corporate structures, particularly for companies championing sustainability.

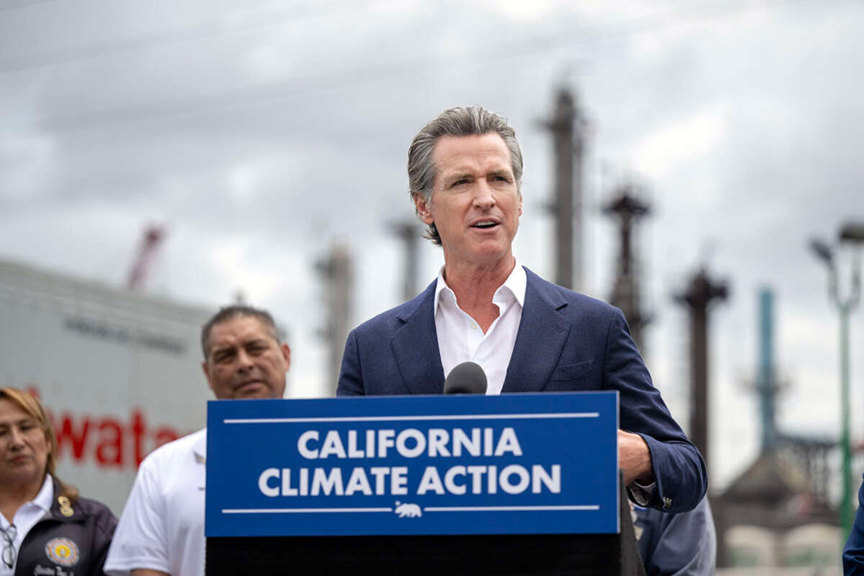

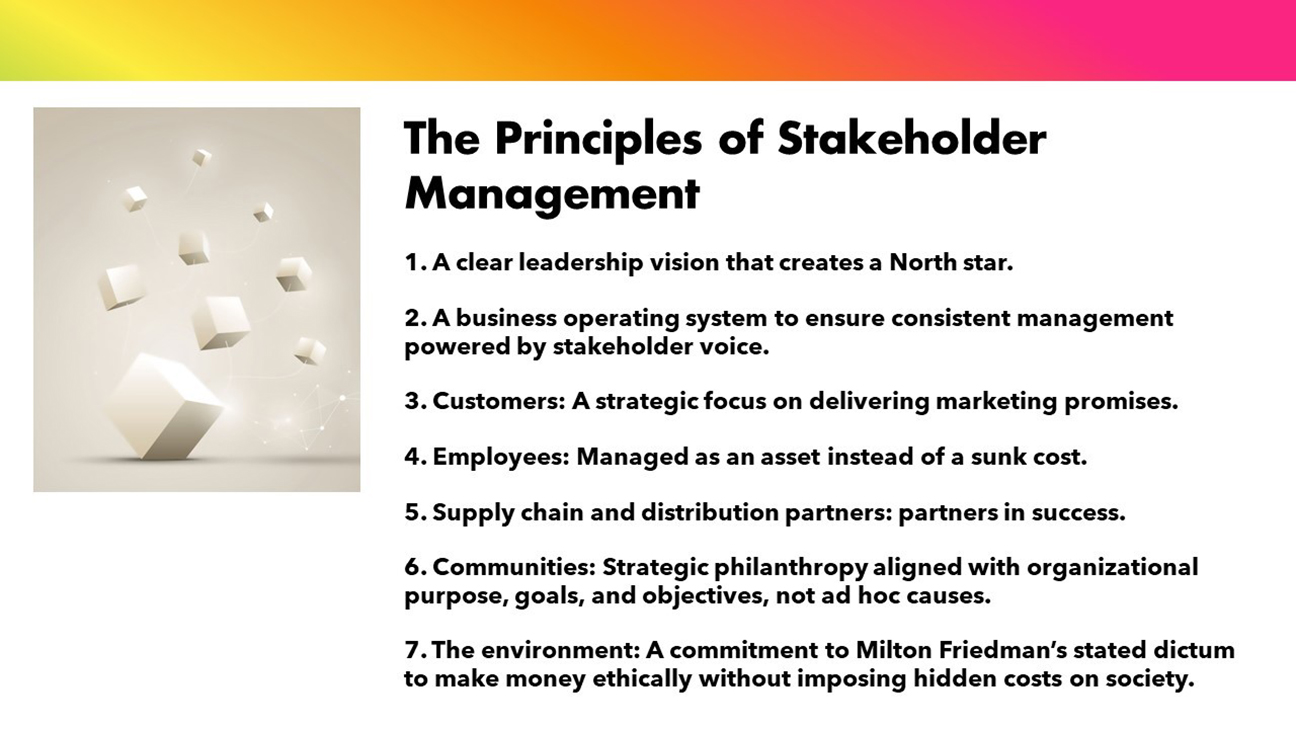

Many environmentally conscious companies have embraced the concept of stakeholder capitalism, emphasizing benefits not only for shareholders but also for customers, employees, suppliers, and communities. However, the prevailing governance structures have historically prioritized financial value for shareholders. The California disclosures are anticipated to expose the limitations of this orientation, hindering comprehensive progress on systemic issues.

As we stand at this juncture of heightened accountability, it becomes imperative to reevaluate the foundations of corporate governance, especially for companies committed to sustainability. The call for stakeholder governance emerges as a solution, aiming to disentangle governance from ownership, thus allowing decision-makers to consider a broader spectrum of interests.

The rise of benefit corporations and increased advocacy for expanded board representation signal a shift toward greater stakeholder power. Public benefit corporations, which now number in the thousands, have evolved from a nascent idea a mere decade ago. Activist ESG investors are taking matters into their own hands by filing shareholder proposals that mandate their portfolio companies to adopt the benefit corporation model.

A compelling alternative gaining traction is the non-charitable perpetual purpose trust (PPT), exemplified by companies like Patagonia and Organically Grown. This flexible governance structure not only preserves a company’s mission but also redefines fiduciary duty to encompass multiple stakeholders, reinvests profits, shares them with stakeholders, and maintains investor involvement even as voting control resides in the trust.

While some may question the viability of such models in competitive markets, evidence suggests that stakeholder-governed companies often gain a competitive edge. The restructuring of companies like Patagonia, redirecting profits towards climate change initiatives, enhances their appeal to both consumers and the talent market.

The issue of attracting capital raises eyebrows, but stakeholder-governed companies can offer attractive returns at lower risk, making them appealing to long-term, patient investors focused on impact. The PPT model is compatible with traditional debt financing, and innovative structures between pure debt and equity provide enticing alternatives.

Skeptics argue that stakeholder models may need refinement, yet the clarity of shareholder primacy does not guarantee investor security. The real concern is whether separating ownership from governance will foster companies that contribute to solving big problems rather than perpetuating them. Stakeholder-governed companies, inherently collaborative and inclined towards public-private partnerships, offer a promising avenue for addressing systemic issues.

As California’s climate disclosure laws unveil areas for reducing carbon emissions, it becomes increasingly clear that fundamental changes in decision-making, accountability structures, and incentive frameworks are essential for tackling not only environmental challenges but a host of systemic issues. This is a transformative moment, inviting companies to embrace stakeholder governance as a pathway to sustainable and impactful corporate practices.