A month after Canon announced its plans to manufacture nano-imprinting lithography machines, the company’s CEO has indicated that these innovative machines will be more affordable than existing technology but may still be subject to trade restrictions when it comes to exporting to China.

Nano-imprinting lithography (NIL) is positioned as an alternative to ultraviolet (EUV) and deep ultraviolet (DUV) photolithography technology, which is commonly used in the production of advanced semiconductor devices. As of now, the Netherlands-based ASML is the sole supplier of EUV and DUV technology, which represents the pinnacle of chipmaking machinery used to mass-produce chips smaller than 7nm. However, the high cost of EUV machines, which can run into the hundreds of millions of dollars, makes this technology inaccessible to many smaller players in the chip market.

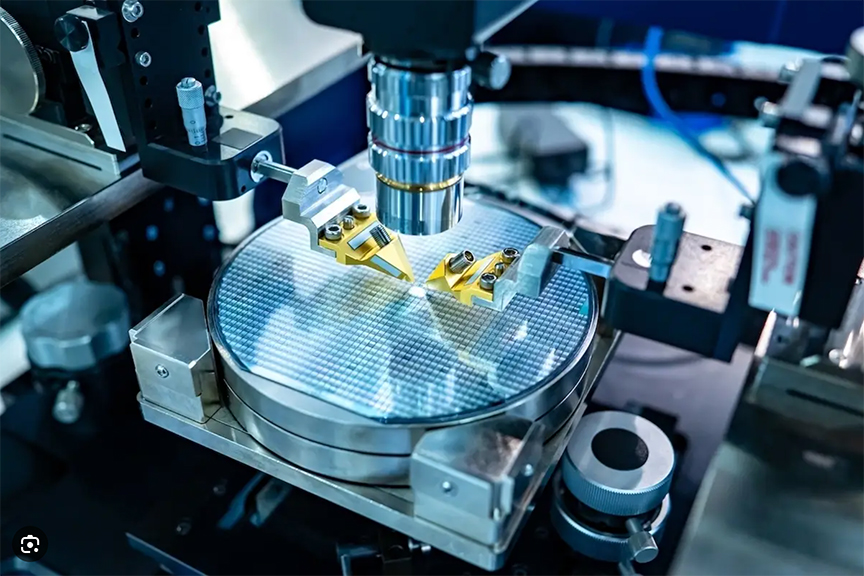

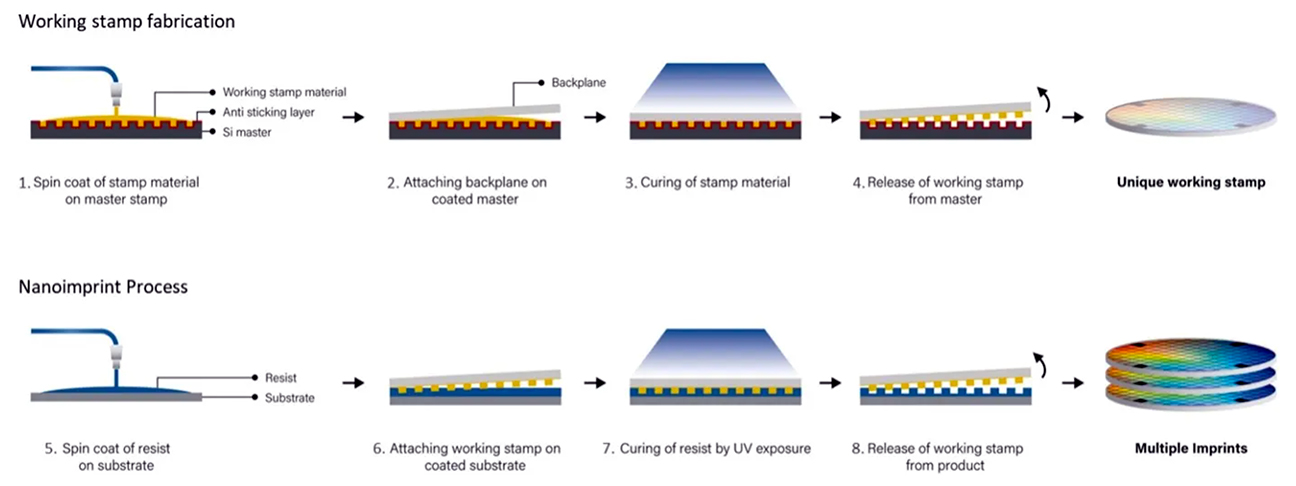

Additionally, due to U.S. sanctions, ASML has been prohibited from exporting its EUV technology to Chinese customers. In contrast, Canon, a Japanese company, recently unveiled its own nano-imprint lithography (NIL) machine capable of producing components down to a 5nm node, with potential for further refinement to 2nm nodes. This novel technology operates by pressing a mask imprinted with the circuit pattern onto the resist-coated wafer, eliminating the need for optical mechanisms in the traditional manufacturing process. Canon expects this approach to reduce machine ownership costs significantly.

Canon’s CEO, Fujio Mitarai, has stated that the price of these nano-imprinting machines will be notably lower than ASML’s EUV technology. However, the final pricing decisions have not yet been made, and Canon has not provided a specific availability timeframe for these machines.

In the context of trade restrictions, the Japanese government has introduced export curbs under pressure from the U.S. Although these restrictions do not explicitly mention nano-imprint technology, Mitarai believes that exports beyond 14nm technology are prohibited. As a result, Canon might face challenges in selling this cutting-edge technology to China.

The backdrop for these developments is a global effort to bolster domestic chip production in response to disruptions in the supply chain caused by the pandemic and the U.S.-China tech trade war. The Japanese government has committed substantial funding to support next-gen chip development in the country, including a partnership with Rapidus to manufacture 2nm chips by 2025. Furthermore, Micron has announced plans to invest significantly in bringing extreme ultraviolet lithography (EUV) to Japan, making it the first company to implement this production method in the country. Micron aims to use these machines to manufacture the next generation of dynamic random access memory (DRAM), popular in digital electronics where low-cost, high-capacity memory is essential.